.png)

not featured

2023-01-20

Press Releases

published

.png)

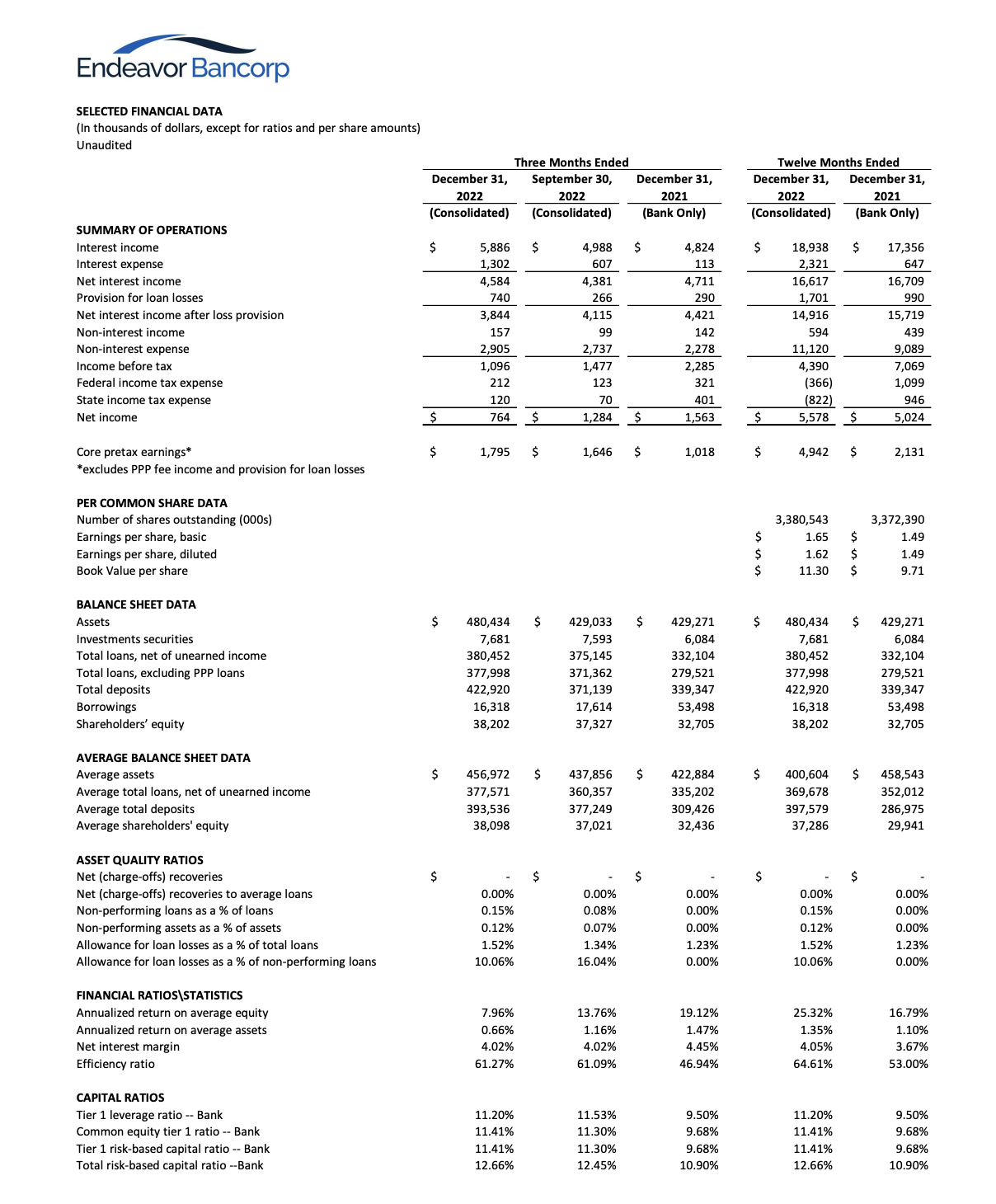

SAN DIEGO, CA -- (January 20, 2023) –Endeavor Bancorp (OTCQX: EDVR) (the “Company,” or “Bancorp”), the holding company for Endeavor Bank (the “Bank”), today announced net income of $764,000 for the fourth quarter of 2022, compared to $1.28 million for the third quarter of 2022, and $1.56 million in the fourth quarter of 2021.

SAN DIEGO, CA -- (January 20, 2023) –Endeavor Bancorp (OTCQX: EDVR) (the “Company,” or “Bancorp”), the holding company for Endeavor Bank (the “Bank”), today announced net income of $764,000 for the fourth quarter of 2022, compared to $1.28 million for the third quarter of 2022, and $1.56 million in the fourth quarter of 2021. The financial data presented in this release is now consolidated, which affected results for the fourth quarter of 2022, third quarter of 2022 and full year 2022. The results presented in this press release for the fourth quarter of 2021 and the full year 2021 were Bank-only periods prior to the formation of the holding company. All results are unaudited.

Results for the fourth quarter of 2022 reflect lower interest and fees on PPP loans compared to the prior quarter and the year ago quarter, due to slowing PPP loan forgiveness as the program nears its conclusion. PPP fee income totaled $41,000 in the fourth quarter of 2022, compared to $97,000 in the preceding quarter, and $1.56 million in the fourth quarter of 2021.

Additionally, fourth quarter 2022 results included a $740,000 provision for loan losses, compared to a $266,000 provision during the preceding quarter and a $290,000 provision in the fourth quarter of 2021. The increased provision during the current quarter reflected management’s evaluation of the risk in the portfolio in the current environment, and was not indicative of any specific loan performance issues.

Excluding PPP fee income and loan loss provisions, the Company’s core pretax, pre-PPP, pre-provision earnings improved to $1.80 million in the fourth quarter of 2022, compared to $1.65 million in the preceding quarter and $1.02 million in the fourth quarter a year ago.

For the year 2022, net income increased to $5.58 million, compared to $5.02 million in 2021. During the year, the Company recorded a $2.51 million one-time deferred tax credit that increased 2022 net earnings. Earnings for 2022 also included $1.15 million in PPP fee income, compared to $5.93 million from PPP fee income in 2021, as fewer PPP loans remain on the books. Additionally, the provision for loan losses totaled $1.70 million in 2022, compared to $990,000 in 2021. Excluding the above-mentioned deferred tax credit, PPP fee income and loan loss provisions, the Company’s core pretax earnings improved to $4.94 million in 2022, compared to $2.13 million in 2021.

“We are pleased with the Company’s progress in 2022 – particularly given market conditions and the challenging economic outlook,” said Dan Yates, CEO. “Our fourth quarter 2022 results reflected solid loan growth, with the loan portfolio, excluding PPP loans increasing 1.8% during the quarter and 35.2% year-over-year. Deposit balances also increased meaningfully during the quarter, despite deposit pricing pressures. While we remain cautious, with rising interest rates and recession concerns on the horizon, our earnings momentum over the past few quarters position us well as we head into 2023.”

“In June 2022, we formed Endeavor Bancorp, a bank holding company that is now the parent company of Endeavor Bank,” Yates continued. “The holding company structure provides us with more capital options to support our growing Southern California franchise, in addition to providing additional revenue generating opportunities.”

The Company’s annualized return on average equity for the fourth quarter of 2022 was 7.96% compared to 13.76% for the third quarter of 2022. Annualized return on average assets for the fourth quarter of 2022 was 0.66% compared to 1.16% for the prior quarter.

Net interest margin was 4.02% for the fourth quarter of 2022, which was unchanged compared to the third quarter of 2022. “We were able to keep our net interest margin stable compared to the preceding quarter, even with a higher cost of funds resulting from the recent Fed rate increases,” said Yates. For the year, net interest margin expanded 38 basispoints to 4.05%, compared to 3.67% in 2021.

Total assets were $480.4 million at December 31, 2022, compared to $429.0 million three months earlier. Total loans, excluding PPP loans, increased $6.6 million, or 1.8% during the fourth quarter to $378.0 million at December 31, 2022, compared to $371.4 at September 30, 2022, and increased $98.5, million or 35.2% when compared to December 31, 2021. As of December 31, 2022, only $2.46 million PPP loans remain out of the $304.1 million originated.

Total deposits increased $51.8 million during the quarter to $422.9 million at December 31, 2022, compared to $371.1 million three months earlier. Compared to a year ago, deposits increased 24.6%. Noninterest bearing checking accounts represented 47.6% of total deposits, interest bearing demand represented 14.4%, and money market and savings accounts comprised 37.2% of the total deposit portfolio at December 31, 2022. Average deposits were $393.5 million in the fourth quarter of 2022, compared to $377.2 million in the preceding quarter.

“In the coming year, we will continue to execute upon our strategy of building a strong community bank, while increasing our visibility and outreach to our shareholders,” said Steve Sefton, President. “We are optimistic about our business outlook in the near term; however, we remain somewhat guarded about our growth prospects in the long term, as inflation and recession risks could dampen loan growth later this year.”

Sefton further stated, “We strategically slowed loan growth in the fourth quarter of 2022. Loan growth was so strong in the earlier part of the year that we paused the rate of growth to allow deposit growth to catch up. We expect to continue this strategy at least through the first quarter of 2023.”

During the second quarter of 2022, the Bancorp board elected to downstream $12 million in Tier 1 capital from Bancorp to the Bank, from proceeds of the sale of $15 million of subordinated debt earlier in 2022. The infusion of capital will allow for additional growth in the months and years ahead. At December 31, 2022, the Bank’s Tier 1 leverage ratio was 11.20%, the Tier 1 risk-based capital ratio was 11.41%, and the Total risk-based capital ratio was 12.66%.

About Endeavor Bancorp

Endeavor Bancorp, the holding company for Endeavor Bank, is primarily owned and operated by Southern Californians for Southern California businesses and their owners. The bank’s focus is local: local decision-making, local board, local founders, local owners, and relationships with local clients in Southern California.

Headquartered in downtown San Diego in the landmark Symphony Towers building, the Bank also operates a loan production and executive administration office in Carlsbad and La Mesa. Endeavor Bank provides traditional business banking services across a broad spectrum of industries and specialties. Unique to the bank is its consultative banking approach that partners our business clients with Endeavor Bank’s senior management. Together, we build strategies and provide resources that solve problems, plan for the future, and help clients’ efforts to grow revenues and profits. On December 7, 2022, Endeavor Bancorp began trading on the OTCQX® Best Market under the symbol “EDVR.” Visit www.bankendeavor.com for more information.

EDVR Shareholders

With many of our shareholders transferring their EDVR shares to their brokerage companies, along with ongoing trading taking place, Bancorp may not have the most current shareholder contact information. If you are an EDVR shareholder and would like to receive information via a more timely method, please complete the Shareholder Communication Preference Form on our website: https://www.bankendeavor.com/investor-relations so we can keep you updated on EDVR news, and invite you to various shareholder networking events throughout the year.

Forward-Looking Statements

This press release includes “forward-looking statements,” as such term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on the current beliefs of Bancorp’s directors and executive officers (collectively, “Management”), as well as assumptions made by and information currently available to Bancorp’s Management. All statements regarding Bancorp’s or the Bank’s business strategy and plans and objectives of Management for future operations, are forward-looking statements. When used in this press release, the words “anticipate,” “believe,” “estimate,” “expect” and “intend” and words or phrases of similar meaning, as they relate to Bancorp or Bancorp’s Management, are intended to identify forward-looking statements. Although Bancorp believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. Important factors that could cause actual results to differ materially from Bancorp’s expectations (“cautionary statements”) are the effects of the COVID-19 pandemic and related government actions on the Bank and its customers, loan losses, changes in interest rates, loss of key personnel, lower lending limits and capital than competitors, regulatory restrictions and oversight of the Bank and Bancorp, the secure and effective implementation of technology, risks related to the local and national economy, Bancorp’s implementation of its business plans and management of growth, loan performance, interest rates, and regulatory matters, the effects of trade, monetary and fiscal policies, inflation, and changes in accounting policies and practices. Based upon changing conditions, if any one or more of these risks or uncertainties materialize, or if any underlying assumptions prove incorrect, actual results may vary materially from those described as anticipated, believed, estimated, expected, or intended. Bancorp does not intend to update these forward-looking statements.