not featured

2023-10-23

Press Releases

published

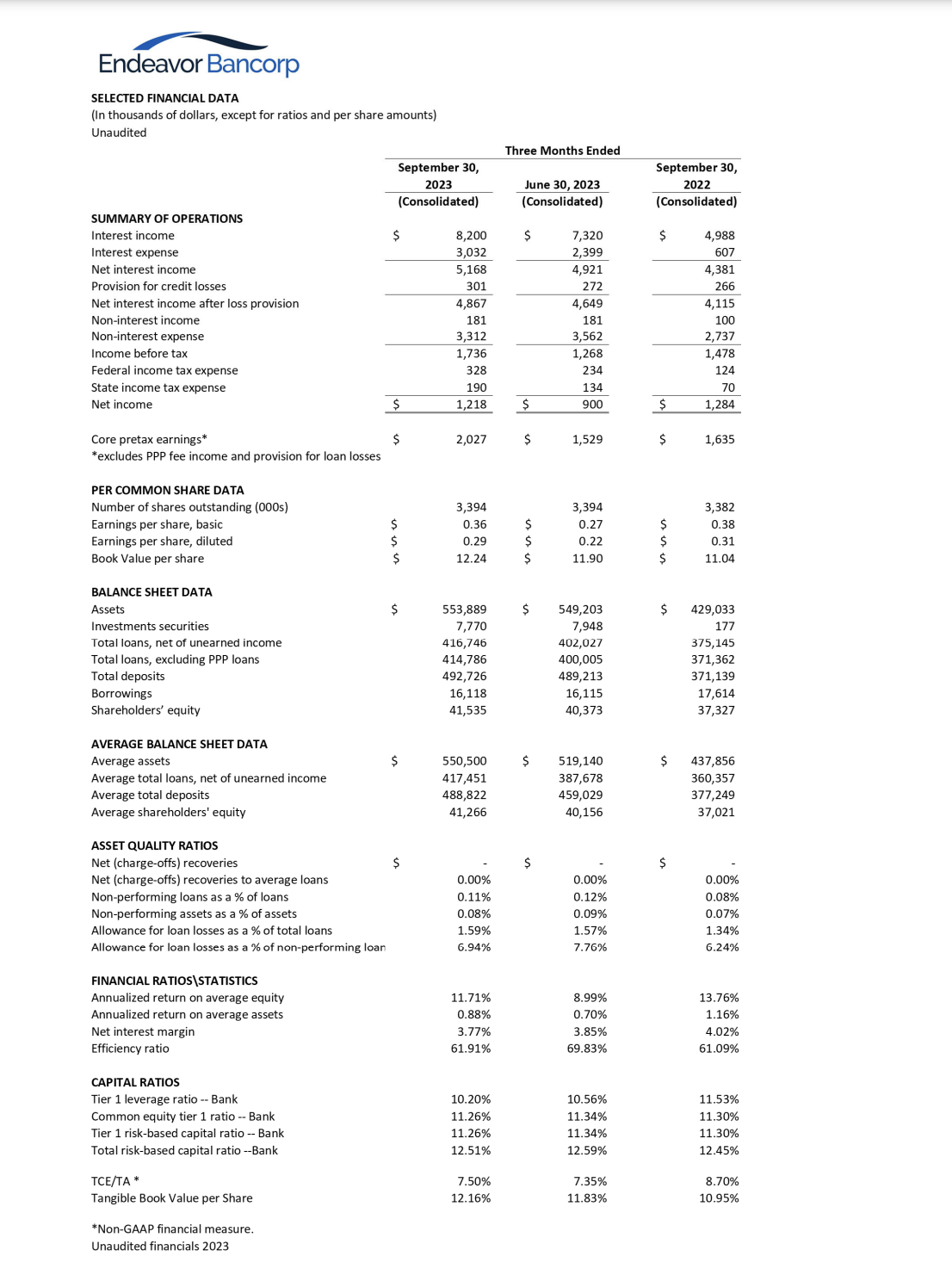

SAN DIEGO, CA -- (October 23, 2023) –Endeavor Bancorp (OTCQX: EDVR) (the “Company,” or “Bancorp”), the holding company for Endeavor Bank (the “Bank”), today announced net income of $1.22 million, or $0.29 per diluted share, for the third quarter of 2023, up from net income of $900,000, or $0.22 per diluted share, for the second quarter of 2023, and down from $1.28 million, or $0.31 per diluted share, for the third quarter of 2022. All 2023 financial results are unaudited.

Results Highlighted by Double Digit Loan and Deposit Growth Year Over Year

SAN DIEGO, CA -- (October 23, 2023) –Endeavor Bancorp (OTCQX: EDVR) (the “Company,” or “Bancorp”), the holding company for Endeavor Bank (the “Bank”), today announced net income of $1.22 million, or $0.29 per diluted share, for the third quarter of 2023, up from net income of $900,000, or $0.22 per diluted share, for the second quarter of 2023, and down from $1.28 million, or $0.31 per diluted share, for the third quarter of 2022. All 2023 financial results are unaudited.

The third quarter 2023 net income results included a $301,000 provision for credit losses, compared to a $272,000 provision expense during the second quarter of 2023, and a $266,000 provision in the third quarter of 2022. Excluding PPP fee income and loan loss provisions, the Company’s core pretax, pre-PPP, pre-provision earnings were $2.03 million in the third quarter of 2023, compared to $1.53 million in the preceding quarter and $1.64 million in the third quarter a year ago. This represents a 24.0% increase year-over-year in adjusted core pretax earnings.

"Our third quarter operating results were highlighted by increased net interest income driven by loan growth,” said Julie Glance, CFO. “While the impact of rising interest rates and robust deposit competition continues to place pressure on our net interest margin (NIM), we are encouraged with the increase in net income during the quarter, which was due to the continued success of our outreach to new and existing clients, while keeping operating expenses in line.”

Total interest income on loans and bank deposits and investments increased $880,000 compared to the preceding quarter, while total interest expenses increased $634,000 during the same timeframe, increasing net interest income by $246,000 during the third quarter of 2023, compared to the preceding quarter. Net interest margin (NIM) decreased eight basis points to 3.77% in the third quarter of 2023 compared to 3.85% in the second quarter of 2023, and 4.02% in the third quarter of 2022.

The Company’s annualized return on average equity for the third quarter of 2023 increased to 11.71% compared to 8.99% for the second quarter of 2023. The annualized return on average assets for the third quarter of 2023 was 0.88% compared to 0.70% for the prior quarter.

Total assets increased $4.7 million, nearly 1% during the third quarter to $553.9 million at September 30, 2023, compared to $549.2 million at June 30, 2023, and increased $124.9 million, or 29.1%, compared to September 30, 2022. Balance sheet liquidity remains very strong with cash balances of $128.3 million, which represents over 23.1% of total assets as of September 30, 2023. The Company’s bond portfolio is minimal representing only 1.40%, or $7.8 million, of total assets at September 30, 2023. In addition, total available borrowing capacity through the Federal Home Loan Bank and the Federal Reserve discount window increased during the third quarter, exceeding $133.5 million as of quarter end. There are no outstanding borrowings as of September 30, 2023.

“Loan growth during the quarter was strong, with net loans increasing 3.7% during the quarter, or 14.8% annualized,” said Steve Sefton, President. “In addition to growing the loan portfolio, we remain focused on a conservative loan composition while maintaining a fortress balance sheet. At quarter end, there were minimal office building loans in the portfolio, and half of the commercial real estate loans were owner-occupied. Further, we generated strong loan originations of $39.5 million during the third quarter of 2023, and a large amount of loan production included undisbursed loans that are expected to fund over the next several quarters.”

Total loans outstanding increased $14.7 million during the third quarter to $416.7 million at September 30, 2023, compared to $402.0 million three months earlier, and increased $41.6 million, or 11.1%, when compared to $375.1 million a year earlier. The Company prides itself on the high-quality loan portfolio, with zero loan charge offs in its history. Total non-performing loans were only 0.11% of the total loan portfolio as of September 30, 2023.

Total deposits increased $3.5 million during the quarter to $492.7 million at September 30, 2023, compared to $489.2 million three months earlier. Compared to a year ago, deposits increased from $371.1 million, up by 32.8%. The loan to deposit ratio was 84.6% at September 30, 2023, compared to 82.2% at June 30, 2023, and remains in line with the Company’s focus of maintaining a loan to deposit ratio between 80.0% to 85.0%.

“Our deposit gathering strategy centers on acquiring new accounts and fostering new client relationships. We continue to be successful at gathering new non-maturity core deposits, which is a testament to our talented team of bankers,” said Dan Yates, CEO. “Total deposits increased $3.5 million compared to the prior quarter end, and are up 32.8% compared to a year ago. We are experiencing deposit growth in part due to the favorable reception of our insured sweep accounts, which offer 100% FDIC insurance through our participation in the IntraFi deposit placement network.”

As a result of its participation in the IntraFi deposit placement network, the Bank accepted “reciprocal” deposits from other institutions, enabling the Bank to offer customers FDIC insurance on accounts in excess of the typical $250,000 FDIC insurance limit. Although the reciprocal deposit accounts maintained through IntraFi’s network are core deposits seeking FDIC insurance, the FDIC rules indicate that reciprocal deposits aggregating over 20% of total liabilities are classified as deposits obtained by or through a deposit broker. The total reciprocal deposits reported as brokered deposits in the Bank’s Call Report were $140.4 million at September 30, 2023, and $140.7 million as of June 30, 2023, all of which are ICS reciprocal sweep deposits.

Shareholders’ equity increased to $41.5 million at September 30, 2023, compared to $40.4 million at June 30, 2023, and $37.3 million at September 30, 2022. Book value per share increased to $12.24 at September 30, 2023, compared to $11.90 three months earlier and $11.04 a year earlier.

The Bank’s Tier 1 leverage ratio remains very strong at 10.20% at September 30,2023, compared to 10.56% at June 30, 2023. The Tier 1 risk-based capital ratio was 11.26% as of September 30, 2023, down slightly compared to 11.34% at June 30, 2023, and the Total risk-based capital ratio was 12.51% compared to 12.59% three months earlier, all of which were well above regulatory minimums.

On January 1, 2023, Endeavor Bancorp implemented the Current Expected Credit Losses (“CECL”) accounting standard, which replaced the former “incurred loss” model for recognizing credit losses with an “expected loss” model. There was no effect to the loan loss provision as a result of the CECL adoption.

About Endeavor Bancorp

Endeavor Bancorp, the holding company for Endeavor Bank, is primarily owned and operated by Southern Californians for Southern California businesses and their owners. The bank’s focus is local: local decision-making, local board, local founders, local owners, and relationships with local clients in Southern California.

Headquartered in downtown San Diego in the Symphony Towers building, the Bank also operates a loan production and executive administration office in Carlsbad and a branch office in La Mesa. Endeavor Bank provides traditional business banking services across a broad spectrum of industries and specialties. Unique to the bank is its consultative banking approach that partners our business clients with Endeavor Bank’s senior management. Together, we build strategies and provide resources that solve problems, plan for the future, and help clients’ efforts to grow revenues and profits. Endeavor Bancorp trades on the OTCQX® Best Market under the symbol “EDVR.” Visit www.endeavor.bank for more information.

This press release does not constitute an offer to sell, or the solicitation of an offer to buy, any security and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offering would be unlawful. The above referenced securities offered and sold by the Company have not been registered under the Securities Act of 1933, as amended, and may not be offered or sold absent registration or an exemption from registration.

Performance Trust Capital Partners LLC was the sole Placement Agent for the offering. Breakwater Law Group provided legal counsel to Endeavor Bancorp, and Hunton Andrews Kurth LLP provided legal counsel to the placement agent.

EDVR Shareholders

With many of our shareholders transferring their EDVR shares to their brokerage companies, along with ongoing trading taking place, Bancorp may not have the most current shareholder contact information. If you are an EDVR shareholder and would like to receive information via a more timely method, please complete the Shareholder Communication Preference Form on our website: https://www.endeavor.bank/investor-relations so we can keep you updated on EDVR news, and invite you to various shareholder networking events throughout the year.

Forward-Looking Statements

This press release includes “forward-looking statements,” as such term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on the current beliefs of the Company’s directors and executive officers (collectively, “Management”), as well as assumptions made by and information currently available to the Company’s Management. All statements regarding the Company’s business strategy and plans and objectives of Management of the Company for future operations, are forward-looking statements. When used in this press release, the words “anticipate,” “believe,” “estimate,” “expect” and “intend” and words or phrases of similar meaning, as they relate to the Company or the Company’s Management, are intended to identify forward looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. Important factors that could cause actual results to differ materially from the Company’s expectations (“cautionary statements”) are loan losses, rapid and unanticipated deposit withdrawals, unavailability of sources of liquidity, additional regulatory requirements that may be imposed on community banks or banks generally, changes in interest rates, loss of key personnel, lower lending limits and capital than competitors, regulatory restrictions and oversight of the Company, the secure and effective implementation of technology, risks related to the local and national economy, changes in real estate values, the Company’s implementation of its business plans and management of growth, loan performance, interest rates, and regulatory matters, the effects of trade, monetary and fiscal policies, inflation, and changes in accounting policies and practices. Based upon changing conditions, if any one or more of these risks or uncertainties materialize, or if any underlying assumptions prove incorrect, actual results may vary materially from those described as anticipated, believed, estimated, expected, or intended. The Company does not intend to update these forward-looking statements.