not featured

2023-01-22

Press Releases

published

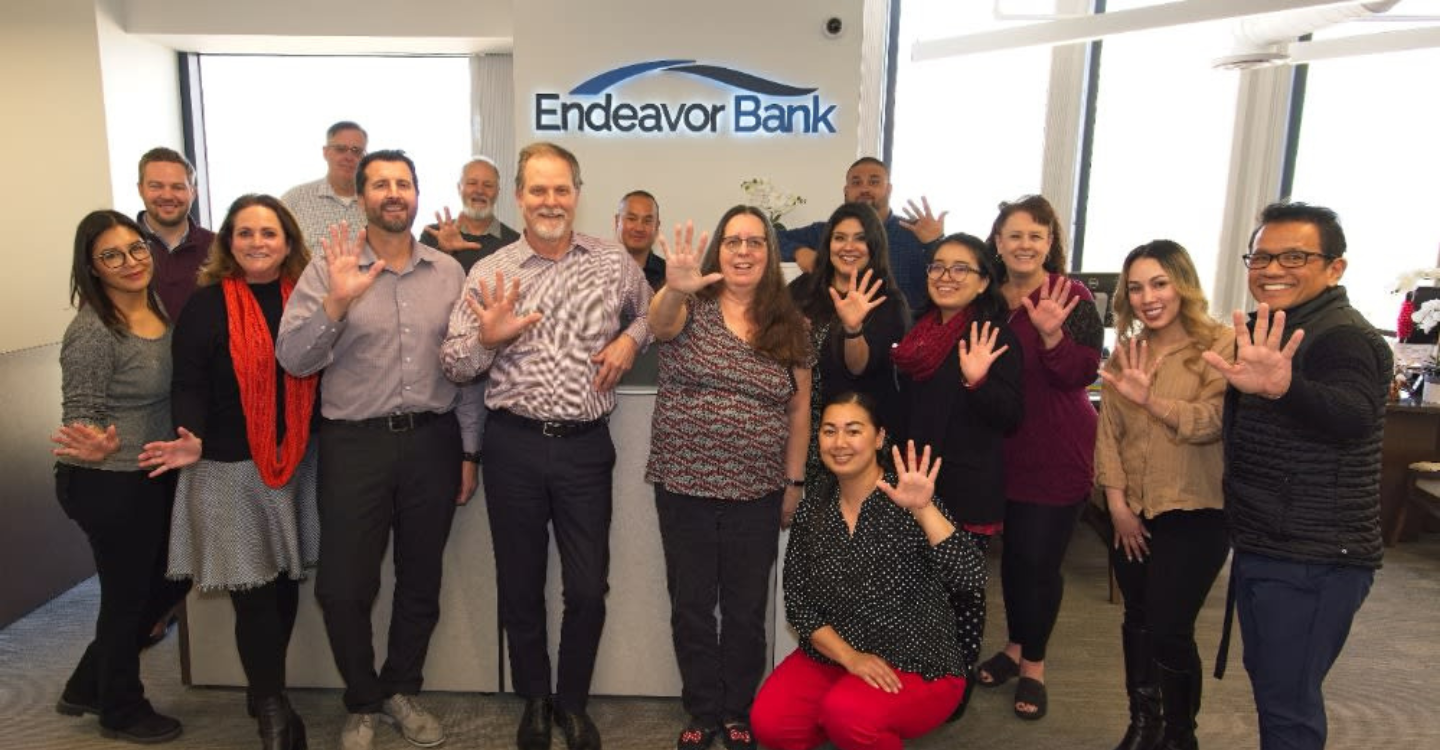

SAN DIEGO -- (January 22, 2023) – Endeavor Bank is celebrating its 5th Anniversary with gratitude to its clients, shareholders, organizers, hard-working team of highly skilled bankers, and board of directors.

SAN DIEGO -- (January 22, 2023) – Endeavor Bank is celebrating its 5th Anniversary with gratitude to its clients, shareholders, organizers, hard-working team of highly skilled bankers, and board of directors. Since opening our first office five years ago - and the first bank charter in San Diego since 2008 - Endeavor has exceeded its growth expectations every year. We are proud to have hit our halfway goal in assets as we target $1 Billion in assets by year 10.

Supporters of the Bank are all local businesspeople who realize that a locally owned bank with local decision makers benefits the economy and community. “Endeavor Bank has always considered the business communities of Southern California as our primary focus,” said Dan Yates, CEO. “As we continue to expand our footprint into East County, we never lose sight of our mission to help local businesses within the communities we serve.”

Steve Sefton, President said “Our hallmark, in addition to traditional loan and deposit solutions, is consultative banking to help clients – Southern California business owners – succeed and grow.” Sefton added, “We continue to invest in technology and safety infrastructure while we expand our reach throughout Southern California. If your business could use at least one good, transformational business idea this year, then we are your bank.”

About Endeavor

Bancorp Endeavor Bancorp, (OTCQX: EDVR) the holding company for Endeavor Bank, is primarily owned and operated by Southern Californiansfor Southern California businesses and their owners. The Bank’s focus is local: local decision making, local board, local founders, local owners, and relationships with local clients in Southern California. Headquartered in downtown San Diego in the landmark Symphony Towers building, the Bank also operates a loan production and executive administration office in Carlsbad and La Mesa. Endeavor Bank provides traditional business banking services across a broad spectrum of industries and specialties. Unique to the bank is its consultative banking approach that partners our business clients with Endeavor Bank’s senior management. Together, we build strategies and provide resources that solve problems, plan for the future, and help clients’ efforts to grow revenues and profits. On December 7, 2022, Endeavor Bancorp began trading on the OTCQX® Best Market under the symbol “EDVR.” Visit www.bankendeavor.com for more information.

Forward-Looking Statements

This press release includes “forward-looking statements,” as such term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on the current beliefs of Bancorp’s directors and executive officers (collectively, “Management”), as well as assumptions made by and information currently available to Bancorp’s Management. All statements regarding Bancorp’s or the Bank’s business strategy and plans and objectives of Management for future operations, are forward-looking statements. When used in this press release, the words “anticipate,” “believe,” “estimate,” “expect” and “intend” and words or phrases of similar meaning, as they relate to Bancorp or Bancorp’s Management, are intended to identify forward-looking statements. Although Bancorp believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. Important factors that could cause actual results to differ materially from Bancorp’s expectations (“cautionary statements”) are the effects of the COVID-19 pandemic and related government actions on the Bank and its customers, loan losses, changes in interest rates, loss of key personnel, lower lending limits and capital than competitors, regulatory restrictions and oversight of the Bank and Bancorp, the secure and effective implementation of technology, risks related to the local and national economy, Bancorp’s implementation of its business plans and management of growth, loan performance, interest rates, and regulatory matters, the effects of trade, monetary and fiscal policies, inflation, and changes in accounting policies and practices. Based upon changing conditions, if any one or more of these risks or uncertainties materialize, or if any underlying assumptions prove incorrect, actual results may vary materially from those described as anticipated, believed, estimated, expected, or intended. Bancorp does not intend to update these forward-looking statements.